What is a Film Waterfall and How Does It Work?

When you release a film, how much of the money is distributed to the filmmakers, and in what order?

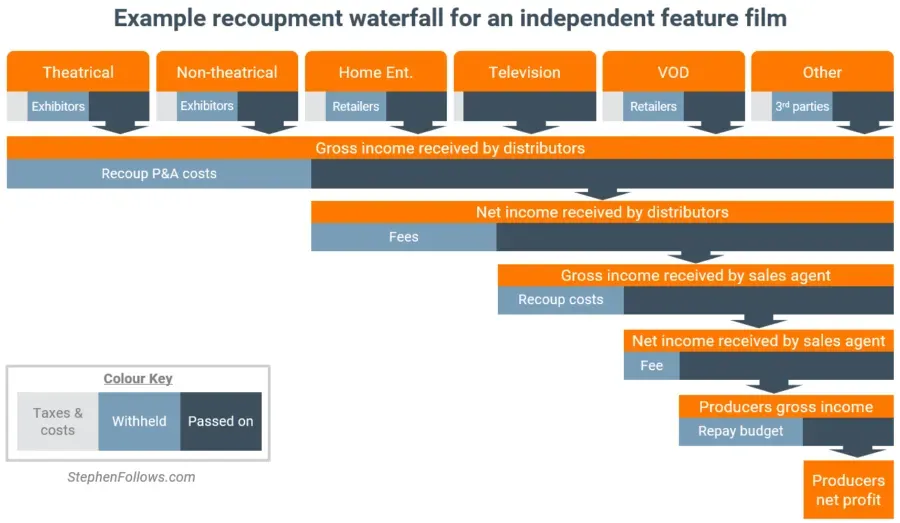

That's the topic of this article. A film's "recoupment waterfall" is a document that shows in detail the way that a film's earnings are distributed, who they are distributed to, in what order, and how money finally ends back up in the investor's and producer's bank accounts.

I'll also use actual numbers and percentages from my previous films, rather than "industry standard numbers" to be as clear as possible how I've seen this play out.

If you're an investor - or have a desire to invest in film - understanding the film's waterfall is essential so that you know how you will (hopefully) recoup your investment and earn a profit.

The Recoupment Waterfall

When you release a film there are several "windows" or distribution channels available to you, including but not limited to:

- Theatrical

- Non-theatrical

- International sales and licensing

- Streaming

- VOD

At each stage and with each channel the metrics are different, but the principle is the same.

For every $10 ticket or rental of your movie, the distributor (or streamer or sales channel) takes a percentage for doing the deal, taxes are withheld, and the balance is passed on to the distributor handling the exhibition of the film.

For example, for a $10 movie ticket, the theater will take 50-60% in the US for an independent film. (Plus they'll take a "processing fee" if they sell the ticket on their website or app, which typically isn't split with the filmmakers.)

The average split on the movies we released in 2024 was around 44%, meaning the theaters kept 56% of the ticket sales.

Who Collects The Money?

The money owed to us is then paid to our distributor, whether it is a digital sale, a rental, or a movie ticket. The distributor is the one making the deal with the exhibitor (theater, streamer, etc) and handles collecting the money earned.

It is from this distribution to the distributor that two things happen:

- The distributor recoups any costs they paid out of pocket for the marketing, prints, and advertising of the film. (Posters, shipping, prints of the movie, etc)

- They take their fee (20-35%) from the net amount.

Say a movie that played in theaters made $5,000,000 from a $1,000,000 production budget and a $200,000 marketing budget.

The theater keeps 56% and pays taxes on the sales of movie tickets. They pay 44% to the distributor, or $2,200,000.

The movie played on 1,000 screens at an average cost of $250 per screen that the distributor paid to get the movie sent over along with prints and shipping. So that's $250,000 that the distributor recoups before reaching a "net revenue" of $1,950,000.

From that, they take a fee of 30%, their share of the revenues of the ticket sales. The balance is distributed to the production company that owns the film, or in some cases a company that manages the CAMA, a Collection Account Management Agreement, which handles the distribution of revenue to all of the parties who have any participation in the returns of the film.

So the distributor, in this case, would get 30% of $1,950,000, or $585,000, and then pass along the rest, or $1,365,000.

The production company or CAMA would first pay back the investors of the movie their $1,000,000, plus interest of 10%, for a total of $1,100,000.

The remaining $265,000 would then be split 50/50 between the investors and the production company, giving the investors another $132,500 in profit, and the production company or producers a matching $132,500.

From that amount, the production company, producers, actors, and anyone else with "backend points" would receive their profit for working on the movie.

Now, that's probably the most simple version, unless the movie was self-funded - meaning there were no investors to pay back.

But you can see how quickly the money goes, and how much you would need to make to recoup your investment and make any profit.

The Position You're In Matters

You may have heard the term "first position" or the phrase "last in, first out."

This is when a secondary investment was made in the film for some reason, like to finish a movie that went over budget, or needed extra funds for post-production, or raised a separate amount for marketing and distributing the movie.

Often, to entice investors, producers will offer a first position, or "last in, first out" position to these investors, capping their returns to 10% or so, and giving them the first money that is returned from the distributor.

This puts the earliest investors at a disadvantage because there are other investors in an earlier position to recoup their investment before the waterfall starts to trickle down to their returns from the movie.

(I'm not a fan of this structure. It poorly treats the earliest investors, and the incentives from the later investors are to spend as little as possible because their investment is better protected the less the film spends.)

I much prefer raising the production and the marketing budget upfront, so there is just one "step" in the waterfall, and no one comes into an earlier position than the earliest investors.

That's what we're doing with the films we produce through Producer Fund I.

More Complicated Waterfalls

Some of the things that can complicate a waterfall include:

- Investors with different deal terms that dictate how much and what position they're in for the film

- Actors/stars that demand a larger cut of the backend

- Whether there are other loans or financing that need to be paid back

- Producers or other crew or cast that have deferred part of their payment for working on the movie

Typically, however, when you are considering an investment into a feature film, the producer(s) will provide you with an explanation of the recoupment waterfall they will be using, which can be signed and made binding by all parties involved.

The best-case scenario is when the producers use a Collection Account Management Agreement (CAMA) so that another company is handling the distribution of the funds according to the agreed-upon waterfall.

Protecting Your Investment

You'll want to make sure you completely understand the waterfall associated with the project you're investing in and ensure you have as good a chance as possible to recoup your investment and make money.

It's good to have an entertainment lawyer you trust to look over all of the documents, including the waterfall, to make sure that it is an investment you feel comfortable making.

The upside from this scenario is that the film earned a profit from a single window, the theatrical release of the film.

Now it has all of the other windows - international, streaming, VOD, cable, and transactional (DVD, purchases, rentals) where the returns are greater - there isn't a theater taking 50%+ - and the waterfall is simpler.

In this scenario there could be millions of dollars in profit to split between the investors and filmmakers, meaning they can happily do it all over again on the next film!

Back to How To Invest In Indie Films

Member discussion